This could be a preview of Deal Transfer, a model new every day publication about large buyouts, large acquisitions and Massive Finance. Like what you see? Subscribe proper right here.

1. Drowning in gives

When a pandemic was declared ultimate spring, Paul Aversano feared the worst.

Aversano leads the worldwide transaction advisory group at Alvarez & Marsal, which works with dealmakers all through the corporate world and private equity. As stock markets plunged, patrons turned their consideration away from new acquisitions and in the direction of shoring up their present portfolio companies. It appeared similar to the industry-wide pipeline of gives was susceptible to drying up.

“I remember ultimate 12 months telling my CEOs, biggest estimate, I really feel our enterprise may be down 50%, and I’d be thrilled if that was the case,” Aversano said.

Infrequently has he been happier to be confirmed so flawed. Deal train did tick down in the midst of the second quarter of ultimate 12 months. Nonetheless earlier than anyone anticipated, the market began to get higher. In the long term, Aversano’s enterprise really elevated in 2023. And in 2023, acquisition train of every sort is hovering to unprecedented heights.

For firm acquirers and private equity corporations, the restoration from the pandemic was swifter than … [+]

getty

Globally, an all-time doc of $1.77 trillion in M&A transactions have been launched via the first 4 months of 2023, based mostly on information from Refinitiv. That’s up a whopping 124% as compared with ultimate 12 months, and it’s 10% higher than the first 4 months of one other 12 months on doc.

“I’ve seen it busy, nevertheless not like this,” said Claudine Cohen, the chief of the transactions and turnaround advisory observe at CohnReznick. “That is type of a frenzy.”

The reasons for the surge are many. Firm patrons and private equity corporations alike are sitting on mountains of dry powder and looking out for places to spend it. Charges of curiosity are at doc lows, launching a hunt for yield. A firehouse of stimulus funding has flooded the globe. A surging stock market is driving confidence. And loads of potential gives which have been postponed by the onset of the pandemic are literally making their strategy to market, creating additional targets than ever.

The gives maintain coming. They often’re getting greater, too—harkening once more to the mega-deal days of the mid-2000s.

This week alone, Thoma Bravo agreed to buy cybersecurity provider Proofpoint

PFPT

O

Rumors and research of even bigger gives have surfaced in present weeks. Private equity corporations are reportedly pursuing a Toshiba takeover that may prime $20 billion. Canadian Nationwide Railway provided to buy fellow rail service Kansas Metropolis Southern

KSU

The standard M&A transaction this 12 months has been worth higher than $100 million, based mostly on Refinitiv. That’s up higher than 25% from the first 4 months of the pre-pandemic 12 months of 2019.

And an unceasing influx of newest capital from LPs means far more mega-deals may be on the best way during which. CVC Capital Companions, Silver Lake, EQT

EQT

KKR

CG

“The scale of the funds that the mega-firms are elevating merely continues to develop, so it’s not beautiful that among the many gives now are once more or in additional of the place they’ve been heading into the financial catastrophe,” said Dave Tayeh, the highest of North American private equity at Investcorp, a middle-market investor. “All through all of the funding world, everybody appears to be looking for yield.”

The rise has been considerably pronounced inside the Americas, the place higher than $1 trillion worth of M&A transactions have already been launched this 12 months, as soon as extra per Refinitiv. That’s 32% higher than one other 12 months on doc, topping the sooner extreme of $792 billion worth of gives via April that was set strategy once more in 2000.

Can the market preserve such a breakneck tempo? Cohen instructed me she sees no indicators of a slowdown and that points might very correctly keep hectic into 2023. As long as capital is that this plentiful and charges of curiosity are this low, patrons are going to keep up spending.

Lastly, though, a reversal will arrive.

“In some unspecified time sooner or later, there may be some event or some buildup of events which will set off a correction, the depth and size of which might be hopefully comparatively manageable,” Tayeh said. “Markets don’t merely go in a single route.”

Aversano laid out one hypothetical state of affairs for the best way the gold rush may end. He pointed to rising prices in commodities like lumber as a doable symptom of inflation, which can lead to an stunning improve in charges of curiosity. Trillions of {{dollars}} in stimulus funding obtained’t on a regular basis be on the market. And, whereas the connection might be not immediately obvious, he thinks a doable SEC crackdown on cryptocurrencies might play a process.

“If you check out charges of curiosity, cryptocurrency and the runout of the stimulus, these are all points which may be propping up most people equity markets, which give of us a means of confidence,” Aversano said. “So in case you’ve got a state of affairs the place the problems which may be propping up most people equity markets type of wean off, and the markets start to go down, you lose confidence. And that may ebb and motion some M&A train.”

So no: The crazy dealmaking days of early 2023 obtained’t ultimate with out finish. Nonetheless that doesn’t make them any a lot much less crazy.

And now on to the rest of our recap of the earlier seven days of gives…

2. SPAC roundup

Legislators and regulators are turning their consideration to SPACs. On Thursday, Sen. John Kennedy (R-La.) proposed a model new bill that may intention to increase transparency regarding the price building for SPAC sponsors, saying in an announcement that it’s “correct and truthful {{that a}} SPAC must disclose how its sponsors receives a fee and the best way that impacts the value of public shares.” The legal guidelines was launched in some unspecified time in the future after Reuters reported that the SEC is considering a change that may cease companies merging with SPACs from making forward-learning earnings estimates, an train that’s already prohibited for companies going public by the use of IPO.

On the an identical time, the SPAC gives maintain coming. Sonder, a startup that manages short-term condominium leases, is able to merge with a blank-check automotive backed by The Gores Group in a deal that values the company at $2.2 billion. And Large Group, the daddy or mom agency of the Betway sports activities actions enjoying mannequin, lined up a SPAC merger of its private which will come at a $5 billion valuation.

3. A PE bounty

Private equity powers KKR and The Carlyle Group launched a deal on Friday to advertise The Bountiful Agency, which owns vitamin and complement producers along with Nature’s Bounty and Puritan’s Pleasure, to Nestle for $5.75 billion. Carlyle acquired the company (then usually often known as NBTY) for $4 billion in 2010 and provided a majority stake to KKR in 2017. The sale to Nestle comes decrease than three weeks after The Bountiful Co. had filed for an IPO.

Info of the exit acquired right here the an identical week Carlyle unveiled its earnings for the first quarter of the 12 months. Try ultimate Thursday’s publication for a full accounting of the company’s latest financials.

4. Enterprise meets politics

China is steady its crackdown on great apps. Regulators have educated Tencent, Didi Chuxing and completely different tech giants that they’ll not be able to present financial suppliers to clients aside from funds, based mostly on a report in The Wall Avenue Journal, the newest sign of Beijing’s newfound wish to preserve tech companies separate from financial suppliers suppliers. Earlier this week, the Journal reported that China was investigating the approval course of for Ant Group’s deliberate IPO, which was scuttled ultimate 12 months inside the first outward sign of the regulatory shift.

China’s sharp response to Jack Ma and Ant Group may be a bellwether for among the many nation’s … [+]

Barcroft Media by the use of Getty Images

The winds of change are moreover blowing inside the Middle East, the place petrostates are rising increasingly open to exterior funding. Saudi Crown Prince Mohammed bin Salman said this week that Aramco was in talks to advertise a 1% stake to “one in every of many primary vitality companies on the earth.” Often, a 1% stake received’t be lots. Nonetheless it’s going to mark a hefty funding in Aramco, which has a market cap of higher than $7 trillion.

5. Close to home

Let’s put the kid gloves on for this one: Reuters reported on Thursday afternoon that Forbes Media is in talks to go public by merging with a SPAC and has acquired various completely different takeover affords, along with a $700 million bid from blockchain-focused investor Borderless Suppliers that may embrace debt financing from Ares Administration

ARES

I’ve no inside data proper right here in anyway. Suffice it to say I may be watching this one rigorously!

6. An leisure IPO

Endeavor, which is prone to be described as an leisure conglomerate, went public on Thursday in an IPO that raised $511 million. The debut acquired right here a few year-and-a-half after Endeavor and CEO Ari Emanuel known as off an earlier attempt to go public. Backed by Silver Lake, the company has its roots inside the WME and IMG experience corporations, nonetheless it now could be prone to be increased recognized for proudly proudly owning the UFC combating group and completely different keep events.

In a single different private equity-backed IPO, Aveanna Healthcare priced its itemizing at $12, the low end of its anticipated differ, to spice up virtually $460 million. Aveanna is a reasonably controversial provider of home healthcare suppliers that’s backed by Bain Capital and J.H. Whitney & Co. And one little little bit of IPO info for the long term: Zomato, an Indian meals provide startup that’s corralled monumental sums of funding in the midst of the pandemic, filed this week to go public in Mumbai in a listing that may elevate $1.1 billion.

7. Tune product sales

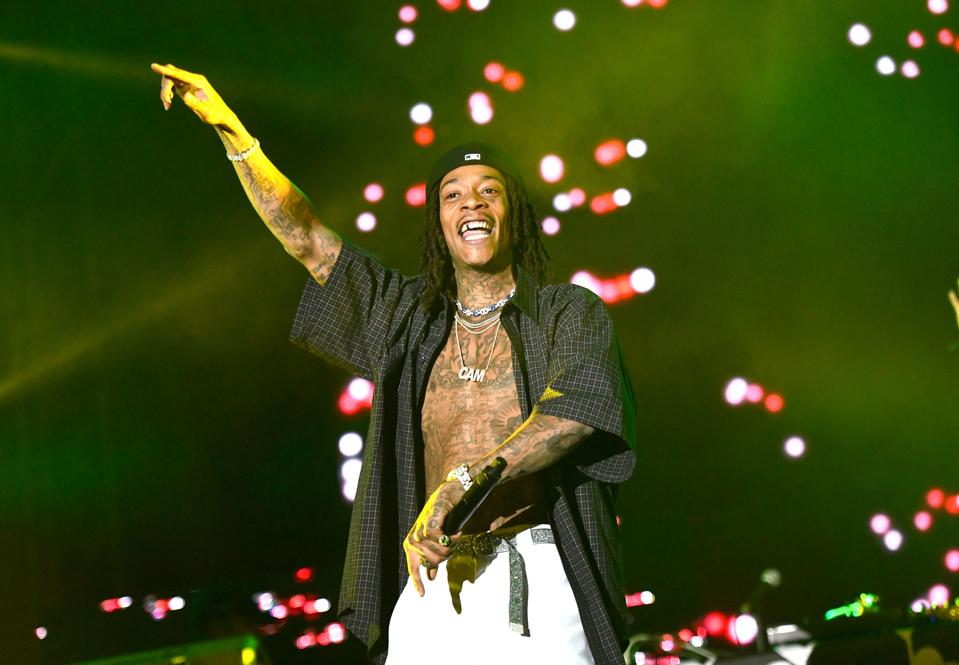

Tempo Music Investments launched in 2019 with $650 million in backing from Windfall Equity Companions and Warner Music Group to put to work inside the burgeoning space of shopping for music catalogs. As a result of the sector has boomed in present months, Tempo has been busy: The company has “quietly” acquired rights from acts along with the Jonas Brothers and Wiz Khalifa, and it now has higher than $1 billion in dry powder, based mostly on a Wall Avenue Journal report.

Wiz Khalifa is probably going one of many latest musical stars to capitalize on a surge of investor curiosity in … [+]

Getty Images

In a single different occasion of investor urge for meals for music rights, my colleague Ariel Shapiro has the knowledge that Paul Simon provided his observe catalog ultimate month for some $250 million. And earlier this week, Blackstone

BX

HAS

GS

8. Shifting gears

Lyft

LYFT

UBER

A pair of various upstarts inside the auto experience space may be on the point of going public, with Bloomberg reporting that Plus and WayRay are every considering SPAC mergers that may well worth the companies at $Three billion and $2 billion, respectively. Plus is a self-driving truck startup backed by various Chinese language language VCs, along with Sequoia’s China arm, whereas WayRay is a developer of augmented actuality experience for vehicles whose backers embody Porsche and Hyundai Motor.

9. The ATL

A set of newest tax incentives over the earlier 20 years have helped flip Atlanta right into a severe hub for the film {{industry}}. This week, that improvement drew the attention of non-public equity, as Commonwealth Group agreed to purchase Blackhall Studios in a reported $120 million deal. Positioned in Atlanta, Blackhall owns a 150-acre difficult of sound phases and completely different facilities which have been used to shoot to present blockbuster films corresponding to “Venom” and “Godzilla: King of the Monsters.”

As far as I can inform, Atlanta has no connection to a personal equity company known as ATL Companions—the New York-based outfit takes its establish from its take care of the aerospace, transportation and logistics sectors. Nonetheless we obtained’t discriminate amongst ATLiens. ATL Companions took a lead perform this week in a $300 million funding in Arrive Logistics, a freight brokerage agency that claims it’s on tempo to eclipse $1 billion in earnings this 12 months for the first time.

Subscribe to Deal Transfer

Finance information

The submit Regardless of Pandemic Fears, A Report-Breaking ‘Frenzy’ Of M&A Exercise Is Underway appeared first on The Black Chronicle.

Powered by WPeMatico