States with the worst credit scores are often some of the most populous in the nation. If you’re wondering why some states have such a poor financial reputation, the answer is a complex one.

Some states are simply worse at managing money than others, while others have suffered from large-scale public corruption. Here are the states with the worst credit scores and why they’re struggling to improve their standing.

What is a Credit Score?

Credit scores are an essential part of your financial health. You should always know your score before applying for any type of credit, from loans to credit cards. There are five main categories that help lenders decide how much to lend you.

- A really bad FICO score is usually 300-579, which can lead to financial struggles when trying to purchase anything more expensive than a pack of gum and a bottle of water.

- The next category, which is 580-669, is considered to be fair, which may afford you some opportunities but won’t be enough for something like a car loan.

- You could have a good or very good FICO score (670-739) which would give you access to the best interest rates and terms when it comes to mortgage loans, mortgages, and other types of debt.

- You’ll need an excellent score — 740-799 — to qualify for the most favorable rates and terms on credit cards.

- Finally, an 800+ credit score qualifies you for the best interest rates and terms on everything from credit cards to mortgages.

FICO Scores are used in over 90% of U.S. lending decisions, making it a must-know number before applying for any financial product.

What is the Lowest Credit Score?

The lowest score in this range is 300

Credit scores are essential to the lending process. The FICO® Score, which is the most popular scoring model, spans a range going from 300 to 850. The average score in this range is 704. The truth of the matter is that nearly nobody has a score below 580, or “bad credit.”

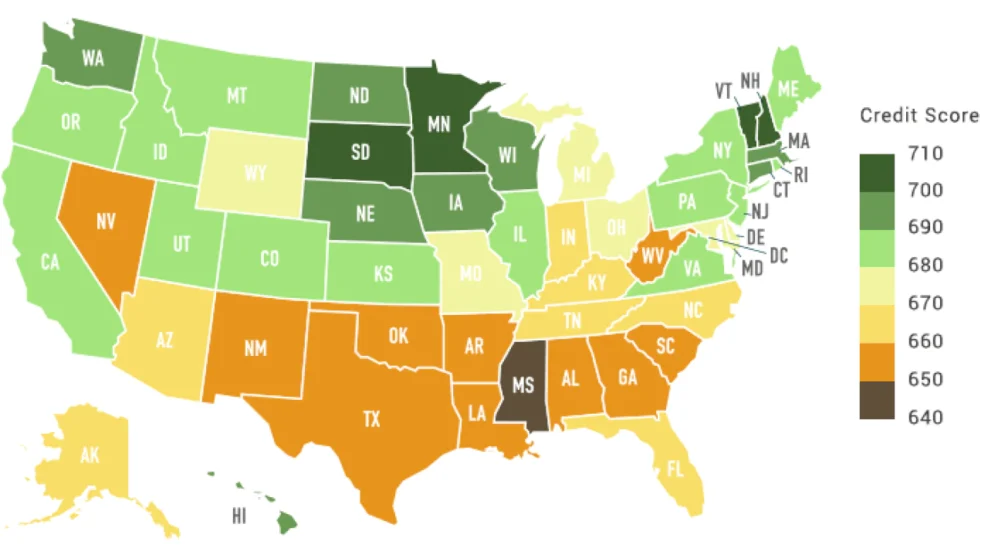

Which States Have the Worst Credit Score?

The 10 states with the lowest median income had an average credit score of 625, $11,087 lower than the national median income according to 2018 census data.

The average mortgage delinquency rate for these states was 1.09 percent, higher than the national average, 0.80%.

Here’s the list:

- Mississippi – 662. Which is even worse, the state also gets into the list of the 10 worst states in the highest credit card delinquency rate.

2. Louisiana – 667. It also has a second-worst delinquency rate in the US.

3. Alabama – 670. Credit card delinquencies, bankrupt rate and unemployment are also extremely low in the state of Alabama which may explain such bad credit rating.

4. Arkansas – 671. This position refers to the state’s high delinquency rates for mortgages, auto loans and credit cards.

5. Oklahoma – 671.The number of the state’s residents who apply for online payday loans in Oklahoma is higher than the average nation’s percentage of short-term loan borrowers. Bad credit and the popularity of Payday Loans are closely interconnected.

6. Texas – 673. Though Texas residents have an average median income of $60,629 they seem to have a much higher medical debt.

7. Georgia – 675. Too much debt in collections.

8. West Virginia – 675. West Virginia boasts the highest mortgage delinquency rate in the country — all due to their high credit score. Though the state has a median amount of debt that is below the national average, it falls woefully short on credit card delinquency. And the state is still doing worse than the national average when it comes to avoiding medical debt collection.

9. Kentucky – 676. Residents had a higher delinquency rate than average, according to National Mortgage Database data, but they have done a better job of avoiding credit card delinquency.

Meanwhile, Kentucky had a median of delinquent credit card debt that was $483 while the national median was $589, according to Urban Institute data.

10. South Carolina – 676. 107% more people there having debt in collections than the national average and 40% of South Carolina’s population having medical debt in collections.

Ways to Improve Your Credit Score

There are many different factors that go into building your score, and some take a long time to evolve. One of the quickest ways to improve your score is to lower your credit utilization ratio.

The problem is that it can be calculated at any given point in time, which means you might be doing a good job of paying off your credit cards each month but still have a bad ratio. A simple fix for this is making bi-weekly payments or asking for higher credit limits.