Video above: A glance again at Madoff’s enterprise confessionBernard Madoff, the notorious architect of an epic securities swindle that burned 1000’s of traders, outfoxed regulators and earned him a 150-year jail time period, died behind bars early Wednesday. He was 82.Madoff’s dying on the Federal Medical Middle in Butner, North Carolina, was confirmed by his lawyer and the Bureau of Prisons.Final 12 months, Madoff’s legal professionals unsuccessfully requested a courtroom to launch him from jail in the course of the coronavirus pandemic, saying he suffered from end-stage renal illness and different persistent medical circumstances.His dying was as a result of pure causes, an individual aware of the matter advised The Related Press. The particular person was not approved to talk publicly and spoke to the AP on the situation of anonymity.For many years, Madoff loved a picture as a self-made monetary guru whose Midas contact defied market fluctuations. A former chairman of the Nasdaq inventory market, he attracted a faithful legion of funding shoppers — from Florida retirees to celebrities comparable to movie director Steven Spielberg, actor Kevin Bacon and Corridor of Fame pitcher Sandy Koufax.However his funding advisory enterprise was uncovered in 2008 as a Ponzi scheme that worn out folks’s fortunes and ruined charities. He turned so hated he wore a bulletproof vest to courtroom.The fraud was believed to be the biggest in Wall Road’s historical past.Over time, court-appointed trustees laboring to unwind the scheme have recovered greater than $14 billion of an estimated $17.5 billion traders put into Madoff’s enterprise. On the time of Madoff’s arrest, faux account statements had been telling shoppers that they had holdings price $60 billion.Madoff pleaded responsible in March 2009 to securities fraud and different prices, saying he was “deeply sorry and ashamed.”After a number of months dwelling underneath home arrest at his $7 million Manhattan penthouse residence, he was led off to jail in handcuffs to scattered applause from offended traders within the courtroom.“He stole from the wealthy. He stole from the poor. He stole from the in between. He had no values,” former investor Tom Fitzmaurice advised the choose on the sentencing. “He cheated his victims out of their cash so he and his spouse … might dwell a lifetime of luxurious past perception.”Madoff’s legal professional in recent times, Brandon Pattern, mentioned in a press release that the financier had “lived with guilt and regret for his crimes” up till his dying.“Though the crimes Bernie was convicted of have come to outline who he was — he was additionally a father and a husband. He was tender spoken and an mental. Bernie was in no way excellent. However no man is,” Pattern mentioned.U.S. District Choose Denny Chin sentenced Madoff to the utmost attainable time period.“Right here, the message have to be despatched that Mr. Madoff’s crimes had been terribly evil and that this type of irresponsible manipulation of the system shouldn’t be merely a cold monetary crime that takes place simply on paper, however it’s as an alternative … one which takes a staggering human toll,” Chin mentioned.A choose issued a forfeiture order stripping Madoff of all his private property, together with actual property, investments, and $80 million in property his spouse, Ruth, had claimed had been hers. The order left her with $2.5 million.The scandal additionally exacted a private toll on the household: One among his sons, Mark, killed himself on the second anniversary of his father’s arrest in 2010. Madoff’s brother, Peter, who helped run the enterprise, was sentenced to 10 years in jail in 2012, regardless of claims he was in the dead of night about his brother’s misdeeds.Madoff’s different son, Andrew, died from most cancers at age 48. Ruth remains to be dwelling.Jerry Reisman, an legal professional for about three dozen Madoff victims, mentioned he’d spoken to a number of after Madoff’s dying.“A few of them are saying they’re having fun with at the present time,” he mentioned. “Nobody sees this as an important loss. Nobody goes to mourn Bernie Madoff. They’re comfortable they’ve survived him.”Madoff was born in 1938 in a lower-middle-class Jewish neighborhood in Queens. Within the monetary world, the story of his rise to prominence — how he left for Wall Road with Peter in 1960 with a couple of thousand {dollars} saved from working as a lifeguard and putting in sprinklers — turned legend.“They had been two struggling youngsters from Queens. They labored exhausting,” mentioned Thomas Morling, who labored intently with the Madoff brothers within the mid-Eighties organising and operating computer systems that made their agency a trusted chief in off-floor buying and selling.“When Peter or Bernie mentioned one thing that they had been going to do, their phrase was their bond,” Morling mentioned in a 2008 interview.Within the Eighties, Bernard L. Madoff Funding Securities occupied three flooring of a midtown Manhattan high-rise. There, together with his brother and later two sons, he ran a reliable enterprise as middlemen between the consumers and sellers of inventory.Madoff raised his profile by utilizing the experience to assist launch Nasdaq, the primary digital inventory change, and have become so revered that he suggested the Securities and Change Fee on the system. However what the SEC by no means came upon was that, behind the scenes, in a separate workplace saved underneath lock and key, Madoff was secretly spinning an online of phantom wealth by utilizing money from new traders to pay returns to outdated ones.An outdated IBM laptop cranked out month-to-month statements exhibiting regular double-digit returns, even throughout market downturns. As of late 2008, the statements claimed investor accounts totaled $65 billion.The ugly fact: No securities had been ever purchased or bought. Madoff’s chief monetary officer, Frank DiPascali, mentioned in a responsible plea in 2009 that the statements detailing trades had been “all faux.”His shoppers, many Jews like Madoff and Jewish charities, mentioned they didn’t know. Amongst them was Nobel Peace Prize winner and Holocaust survivor Elie Wiesel, who recalled assembly Madoff years earlier at a dinner the place they talked about historical past, schooling and Jewish philosophy — not cash.Madoff “made an excellent impression,” Wiesel mentioned throughout a 2009 panel dialogue on the scandal. Wiesel admitted that he purchased into “a fantasy that he created round him that all the things was so particular, so distinctive, that it needed to be secret.”Like lots of his shoppers, Madoff and his spouse loved a lavish life-style. That they had the Manhattan residence, an $11 million property in Palm Seashore, Florida and a $4 million residence on the tip of Lengthy Island. There was yet one more residence within the south of France, personal jets and a yacht.All of it got here crashing down within the winter of 2008 with a dramatic confession. In a gathering together with his sons, he confided his enterprise was “all only one massive lie.”After the assembly, a lawyer for the household contacted regulators, who alerted the federal prosecutors and the FBI. Madoff was in a bathrobe when two FBI brokers arrived at his door unannounced on a December morning. He invited them in, then confessed after being requested “if there’s an harmless clarification,” a felony criticism mentioned.Madoff responded: “There isn’t a harmless clarification.”Madoff insisted he acted alone — one thing the FBI by no means believed.A trustee was appointed to recuperate funds — generally by suing hedge funds and different giant traders who got here out forward. The trouble remains to be ongoing, and up to now has returned round 70% of misplaced funds to traders.Greater than 15,400 claims in opposition to Madoff had been filed.At Madoff’s sentencing in 2009, wrathful former shoppers stood to demand the utmost punishment. Madoff himself spoke in a monotone for about 10 minutes. At varied occasions, he referred to his monumental fraud as a “drawback,” “an error of judgment” and “a tragic mistake.”He claimed he and his spouse had been tormented, saying she “cries herself to sleep each night time, realizing all of the ache and struggling I’ve precipitated.”“That’s one thing I dwell with, as properly,” he mentioned.Afterward, Ruth Madoff — typically a goal of victims’ scorn since her husband’s arrest — mentioned she, too, had been misled by her highschool sweetheart.“I’m embarrassed and ashamed,” she mentioned. “Like everybody else, I really feel betrayed and confused. The person who dedicated this horrible fraud shouldn’t be the person whom I’ve identified for all these years.”A few dozen Madoff staff and associates had been charged. 5 went on trial in 2013.DiPascali was the prosecution’s star witness. He recounted how simply earlier than the scheme was uncovered, Madoff referred to as him into his workplace.“He’d been staring out the window the all day,” DiPascali testified. “He turned to me and he mentioned, crying, ‘I’m on the finish of my rope. … Don’t you get it? The entire goddamn factor is a fraud.’”In the long run, that fraud introduced contemporary which means to “Ponzi scheme,” named after Charles Ponzi, who was convicted of mail fraud after bilking 1000’s of individuals out of a mere $10 million between 1919 and 1920.“Charles Ponzi is now a footnote,” mentioned Anthony Sabino, a protection lawyer specializing in white collar felony protection. “They’re now Madoff schemes.”

Video above: A glance again at Madoff’s enterprise confession

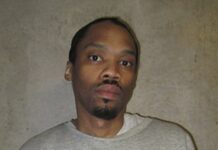

Bernard Madoff, the notorious architect of an epic securities swindle that burned 1000’s of traders, outfoxed regulators and earned him a 150-year jail time period, died behind bars early Wednesday. He was 82.

Commercial

Madoff’s dying on the Federal Medical Middle in Butner, North Carolina, was confirmed by his lawyer and the Bureau of Prisons.

Final 12 months, Madoff’s legal professionals unsuccessfully requested a courtroom to launch him from jail in the course of the coronavirus pandemic, saying he suffered from end-stage renal illness and different persistent medical circumstances.

His dying was as a result of pure causes, an individual aware of the matter advised The Related Press. The particular person was not approved to talk publicly and spoke to the AP on the situation of anonymity.

For many years, Madoff loved a picture as a self-made monetary guru whose Midas contact defied market fluctuations. A former chairman of the Nasdaq inventory market, he attracted a faithful legion of funding shoppers — from Florida retirees to celebrities comparable to movie director Steven Spielberg, actor Kevin Bacon and Corridor of Fame pitcher Sandy Koufax.

However his funding advisory enterprise was uncovered in 2008 as a Ponzi scheme that worn out folks’s fortunes and ruined charities. He turned so hated he wore a bulletproof vest to courtroom.

The fraud was believed to be the biggest in Wall Road’s historical past.

Over time, court-appointed trustees laboring to unwind the scheme have recovered greater than $14 billion of an estimated $17.5 billion traders put into Madoff’s enterprise. On the time of Madoff’s arrest, faux account statements had been telling shoppers that they had holdings price $60 billion.

Madoff pleaded responsible in March 2009 to securities fraud and different prices, saying he was “deeply sorry and ashamed.”

After a number of months dwelling underneath home arrest at his $7 million Manhattan penthouse residence, he was led off to jail in handcuffs to scattered applause from offended traders within the courtroom.

“He stole from the wealthy. He stole from the poor. He stole from the in between. He had no values,” former investor Tom Fitzmaurice advised the choose on the sentencing. “He cheated his victims out of their cash so he and his spouse … might dwell a lifetime of luxurious past perception.”

Madoff’s legal professional in recent times, Brandon Pattern, mentioned in a press release that the financier had “lived with guilt and regret for his crimes” up till his dying.

“Though the crimes Bernie was convicted of have come to outline who he was — he was additionally a father and a husband. He was tender spoken and an mental. Bernie was in no way excellent. However no man is,” Pattern mentioned.

U.S. District Choose Denny Chin sentenced Madoff to the utmost attainable time period.

“Right here, the message have to be despatched that Mr. Madoff’s crimes had been terribly evil and that this type of irresponsible manipulation of the system shouldn’t be merely a cold monetary crime that takes place simply on paper, however it’s as an alternative … one which takes a staggering human toll,” Chin mentioned.

A choose issued a forfeiture order stripping Madoff of all his private property, together with actual property, investments, and $80 million in property his spouse, Ruth, had claimed had been hers. The order left her with $2.5 million.

The scandal additionally exacted a private toll on the household: One among his sons, Mark, killed himself on the second anniversary of his father’s arrest in 2010. Madoff’s brother, Peter, who helped run the enterprise, was sentenced to 10 years in jail in 2012, regardless of claims he was in the dead of night about his brother’s misdeeds.

Madoff’s different son, Andrew, died from most cancers at age 48. Ruth remains to be dwelling.

Jerry Reisman, an legal professional for about three dozen Madoff victims, mentioned he’d spoken to a number of after Madoff’s dying.

“A few of them are saying they’re having fun with at the present time,” he mentioned. “Nobody sees this as an important loss. Nobody goes to mourn Bernie Madoff. They’re comfortable they’ve survived him.”

Madoff was born in 1938 in a lower-middle-class Jewish neighborhood in Queens. Within the monetary world, the story of his rise to prominence — how he left for Wall Road with Peter in 1960 with a couple of thousand {dollars} saved from working as a lifeguard and putting in sprinklers — turned legend.

“They had been two struggling youngsters from Queens. They labored exhausting,” mentioned Thomas Morling, who labored intently with the Madoff brothers within the mid-Eighties organising and operating computer systems that made their agency a trusted chief in off-floor buying and selling.

“When Peter or Bernie mentioned one thing that they had been going to do, their phrase was their bond,” Morling mentioned in a 2008 interview.

Within the Eighties, Bernard L. Madoff Funding Securities occupied three flooring of a midtown Manhattan high-rise. There, together with his brother and later two sons, he ran a reliable enterprise as middlemen between the consumers and sellers of inventory.

Madoff raised his profile by utilizing the experience to assist launch Nasdaq, the primary digital inventory change, and have become so revered that he suggested the Securities and Change Fee on the system. However what the SEC by no means came upon was that, behind the scenes, in a separate workplace saved underneath lock and key, Madoff was secretly spinning an online of phantom wealth by utilizing money from new traders to pay returns to outdated ones.

An outdated IBM laptop cranked out month-to-month statements exhibiting regular double-digit returns, even throughout market downturns. As of late 2008, the statements claimed investor accounts totaled $65 billion.

The ugly fact: No securities had been ever purchased or bought. Madoff’s chief monetary officer, Frank DiPascali, mentioned in a responsible plea in 2009 that the statements detailing trades had been “all faux.”

His shoppers, many Jews like Madoff and Jewish charities, mentioned they didn’t know. Amongst them was Nobel Peace Prize winner and Holocaust survivor Elie Wiesel, who recalled assembly Madoff years earlier at a dinner the place they talked about historical past, schooling and Jewish philosophy — not cash.

Madoff “made an excellent impression,” Wiesel mentioned throughout a 2009 panel dialogue on the scandal. Wiesel admitted that he purchased into “a fantasy that he created round him that all the things was so particular, so distinctive, that it needed to be secret.”

Like lots of his shoppers, Madoff and his spouse loved a lavish life-style. That they had the Manhattan residence, an $11 million property in Palm Seashore, Florida and a $4 million residence on the tip of Lengthy Island. There was yet one more residence within the south of France, personal jets and a yacht.

All of it got here crashing down within the winter of 2008 with a dramatic confession. In a gathering together with his sons, he confided his enterprise was “all only one massive lie.”

After the assembly, a lawyer for the household contacted regulators, who alerted the federal prosecutors and the FBI. Madoff was in a bathrobe when two FBI brokers arrived at his door unannounced on a December morning. He invited them in, then confessed after being requested “if there’s an harmless clarification,” a felony criticism mentioned.

Madoff responded: “There isn’t a harmless clarification.”

Madoff insisted he acted alone — one thing the FBI by no means believed.

A trustee was appointed to recuperate funds — generally by suing hedge funds and different giant traders who got here out forward. The trouble remains to be ongoing, and up to now has returned round 70% of misplaced funds to traders.

Greater than 15,400 claims in opposition to Madoff had been filed.

At Madoff’s sentencing in 2009, wrathful former shoppers stood to demand the utmost punishment. Madoff himself spoke in a monotone for about 10 minutes. At varied occasions, he referred to his monumental fraud as a “drawback,” “an error of judgment” and “a tragic mistake.”

He claimed he and his spouse had been tormented, saying she “cries herself to sleep each night time, realizing all of the ache and struggling I’ve precipitated.”

“That’s one thing I dwell with, as properly,” he mentioned.

Afterward, Ruth Madoff — typically a goal of victims’ scorn since her husband’s arrest — mentioned she, too, had been misled by her highschool sweetheart.

“I’m embarrassed and ashamed,” she mentioned. “Like everybody else, I really feel betrayed and confused. The person who dedicated this horrible fraud shouldn’t be the person whom I’ve identified for all these years.”

A few dozen Madoff staff and associates had been charged. 5 went on trial in 2013.

DiPascali was the prosecution’s star witness. He recounted how simply earlier than the scheme was uncovered, Madoff referred to as him into his workplace.

“He’d been staring out the window the all day,” DiPascali testified. “He turned to me and he mentioned, crying, ‘I’m on the finish of my rope. … Don’t you get it? The entire goddamn factor is a fraud.’”

In the long run, that fraud introduced contemporary which means to “Ponzi scheme,” named after Charles Ponzi, who was convicted of mail fraud after bilking 1000’s of individuals out of a mere $10 million between 1919 and 1920.

“Charles Ponzi is now a footnote,” mentioned Anthony Sabino, a protection lawyer specializing in white collar felony protection. “They’re now Madoff schemes.”